vermont income tax brackets

2021 Tax Year Return Calculator in 2022. 5 rows Vermont Income Taxes.

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Income tax brackets are a helpful way to visualize your state and federal tax rate for the 2020 - 2021 filing season.

. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. 40510001 - and above. Vermonts income taxes are examples of tiered rates.

Five tax rates tax income earned in different amounts or bands at higher levels. Now that were done with federal payroll taxes lets look at Vermont state income taxes. 15 Tax Calculators 15 Tax Calculators.

4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax. In Vermont theres a tax rate of 335 on the first 0 to 40350 of income for single or married filing taxes separately. Most tiered rates are structured to be progressive.

The first step towards understanding Vermonts tax code is knowing the basics. The lowest rate starts at 355 then progressively bumps up to 7 825 89 and tops out at 94. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15. 355 on the first 37450 of taxable income. 78 on taxable income between.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Vermonts income tax brackets were last changed one year prior to 2005 for tax year 2004 and. VT or Vermont Income Tax Brackets by Tax Year.

Tax Rates and Charts Mon 03012021 - 1200. Vermonts income tax brackets were last changed one year prior to 2005 for tax year 2004 and the tax rates have not been changed since at least 2001. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875.

Illinois income tax rates were last changed four years prior to 2020 for tax year 2016 and the tax brackets have not been changed since at least 2001. Vermont has a progressive state income tax. Liability increases smoothly from bracket to bracket.

Vermont also has a 600 percent to 85 percent corporate income tax rate. Vermont Tax Brackets for Tax Year 2020. Vermonts income tax rates are assessed over 5 tax brackets.

W-4VT Employees Withholding Allowance Certificate. Vermont State Personal Income Tax Rates and Thresholds in 2022. Your average tax rate is 1198 and your marginal tax rate is 22.

Employees who make 204001 or more will hit the highest tax bracket. Vermonts sales tax is an example of a fixed rate. If youre married filing taxes jointly theres a tax rate of 335 from 0 to 67450.

Taxpayer pays only the assigned rate for each. 2021 Vermont Income Tax Return Booklet. Heres a quick summary of Vermonts personal income tax laws.

PA-1 Special Power of Attorney. Tax Bracket Tax Rate. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of.

The 2022 tax rates range from 335 on the low end to 875 on the high end. Vermont Income Tax Calculator 2021 If you make 70000 a year living in the region of Vermont USA you will be taxed 10996. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state.

FY2022 Education Property Tax Rates as of August 18 2021. 2020 VT Tax Tables. A list of Income Tax Brackets and Rates By Which You Income is Calculated.

Tax Rates Tax rates can be fixed or tiered. 68 on taxable income between 37451 and 90750. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax.

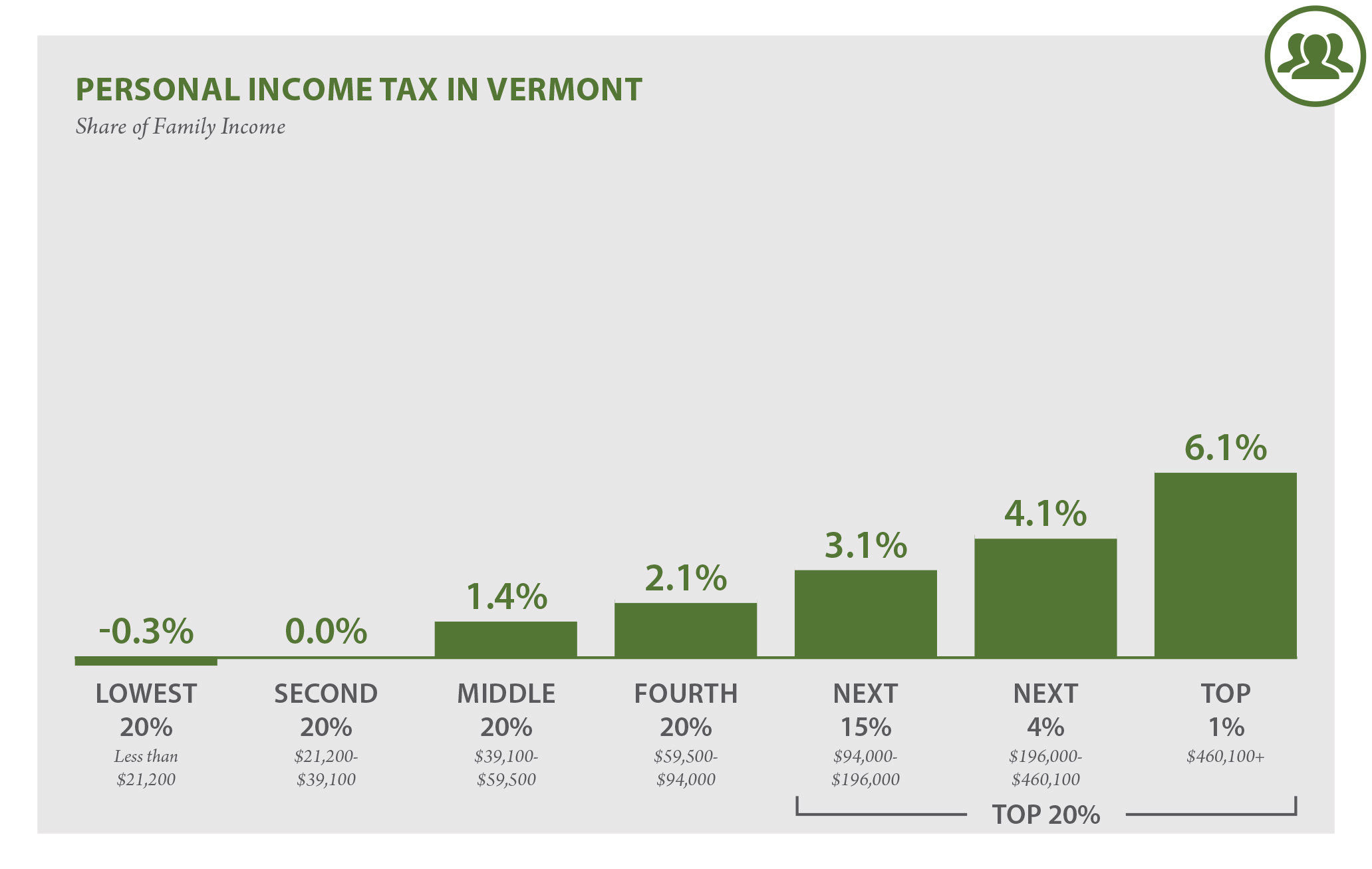

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Is not a state but it has its own income tax rate. Tiered rates are typically structured as a series of brackets.

Income tax brackets are required state taxes in. IN-111 Vermont Income Tax Return. Where is My Refund.

This income tax calculator can help estimate your average income tax rate and your salary after tax. The first step towards understanding Vermonts tax code is knowing the basics. Vermont has four tax brackets for the 2021 tax year which is a.

Vermont charges a progressive income tax broken down into four tax brackets. DATEucator - Your 2022 Tax Refund Date. Vermont based on relative income and earningsVermont state income taxes are.

Vermont School District Codes.

Vermont Income Tax Brackets 2020

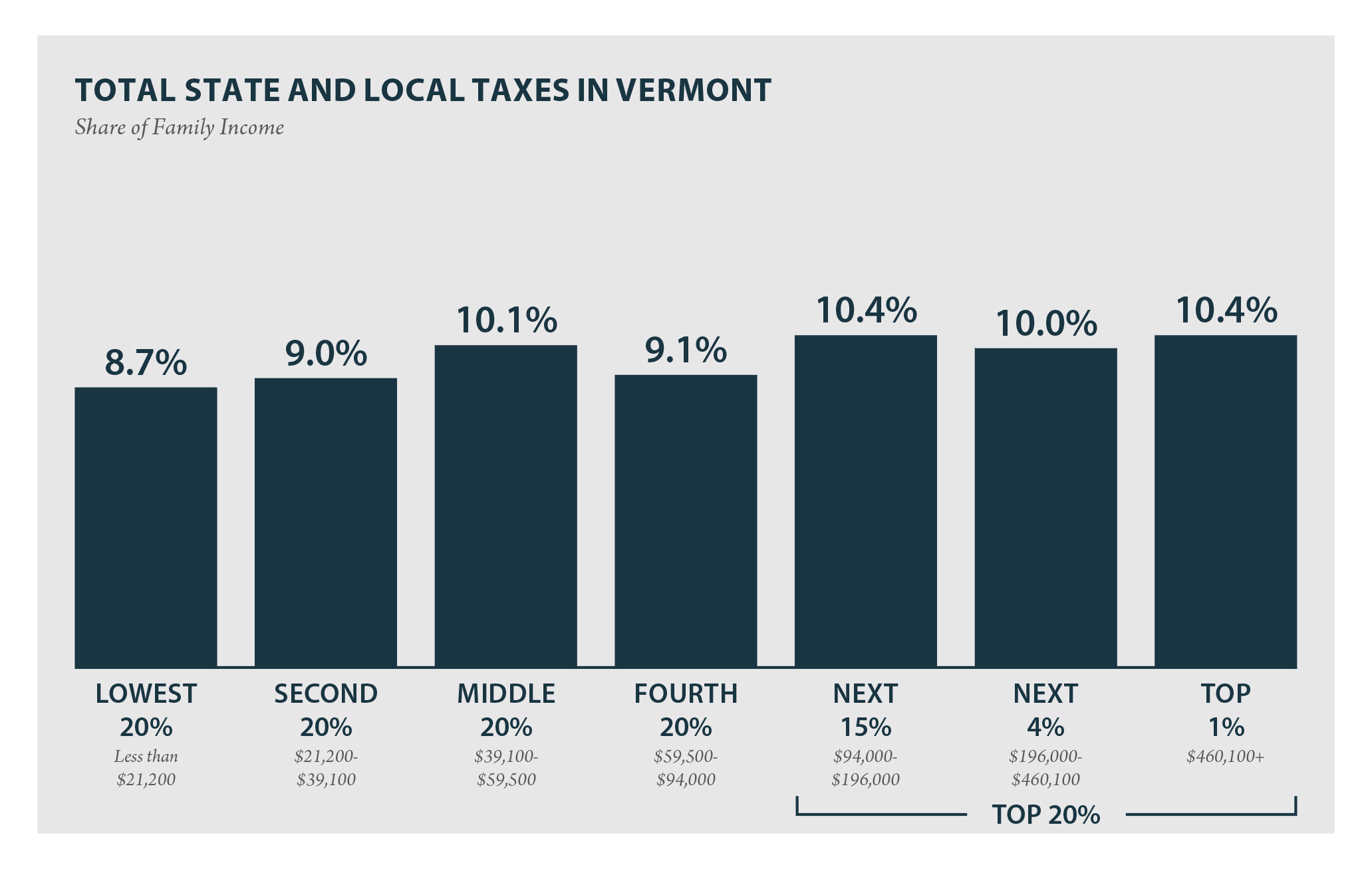

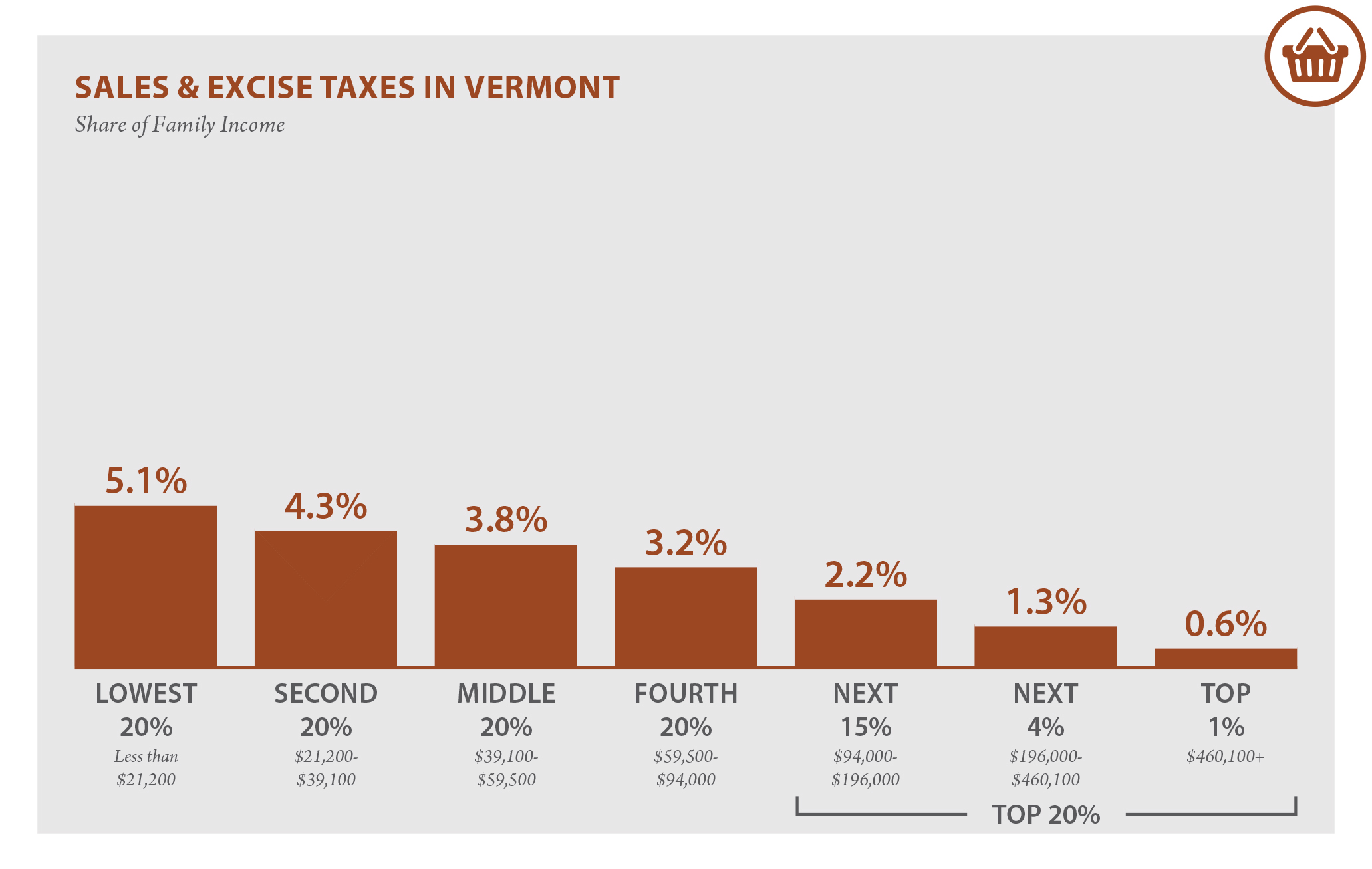

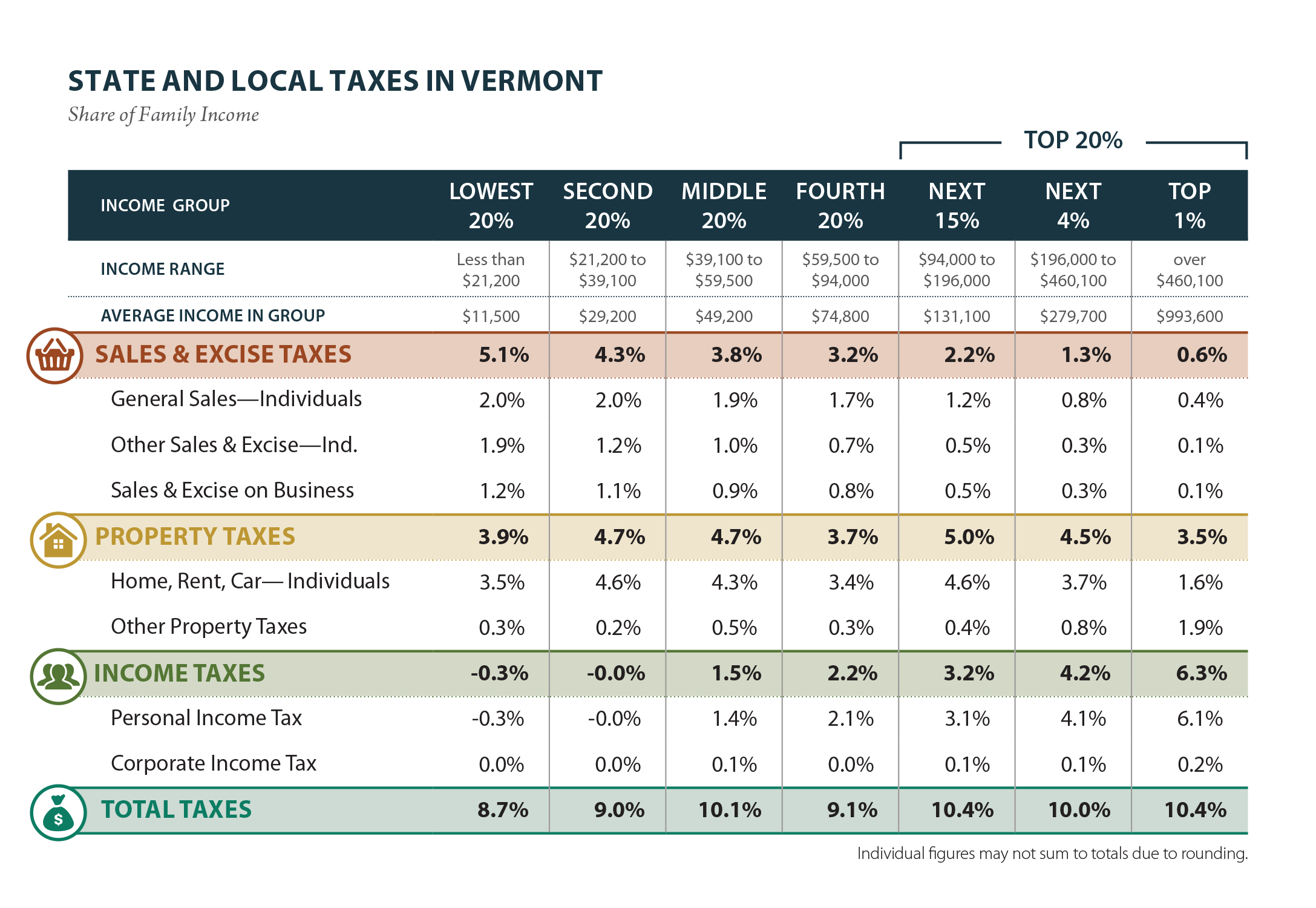

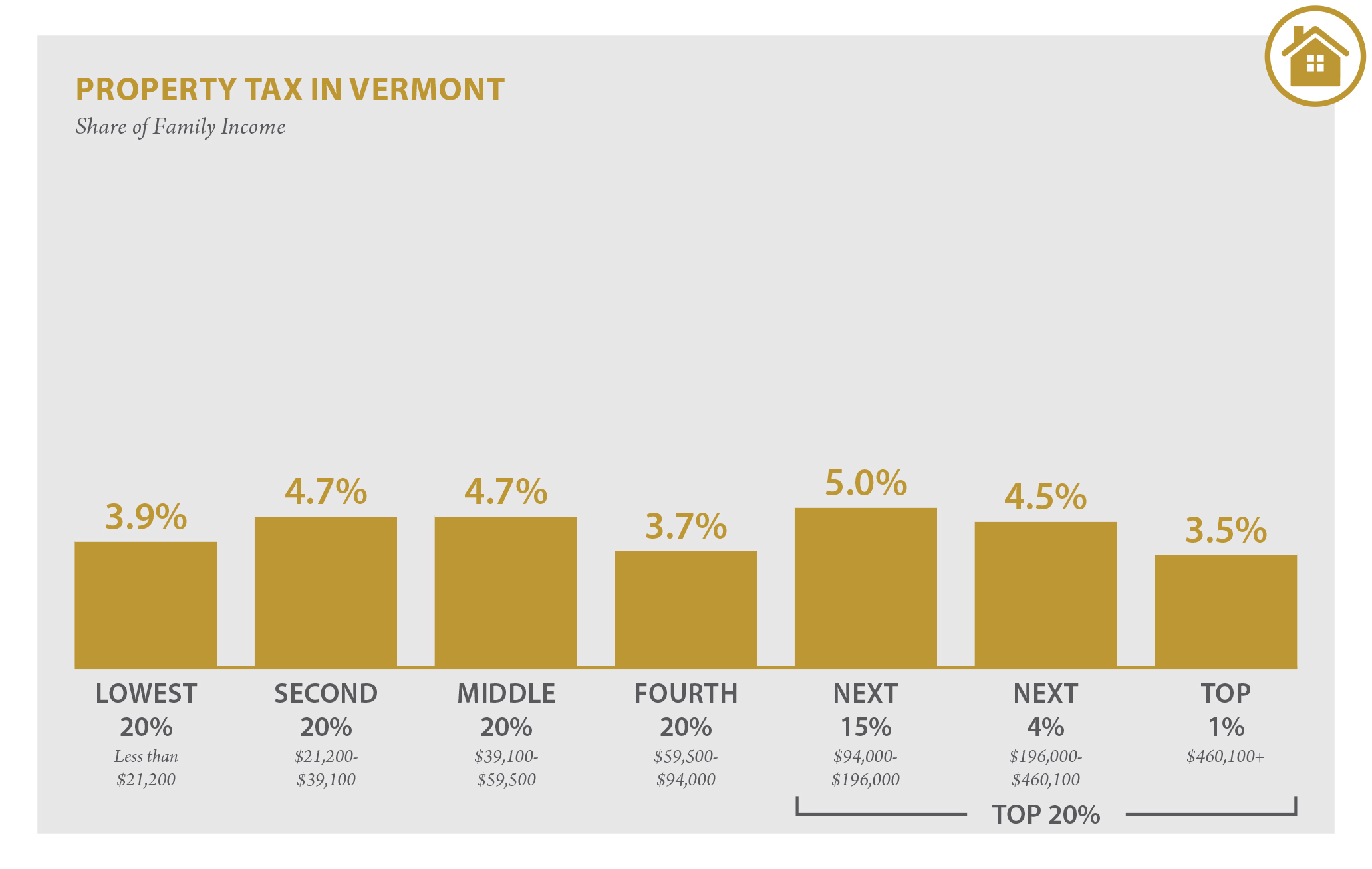

Vermont S Tax System Is Still Unfair Public Assets Institute

Vermont Income Tax Vt State Tax Calculator Community Tax

4 27 15 The Carolina Cage Match Peter Shumlin Versus Rational Public Policy

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

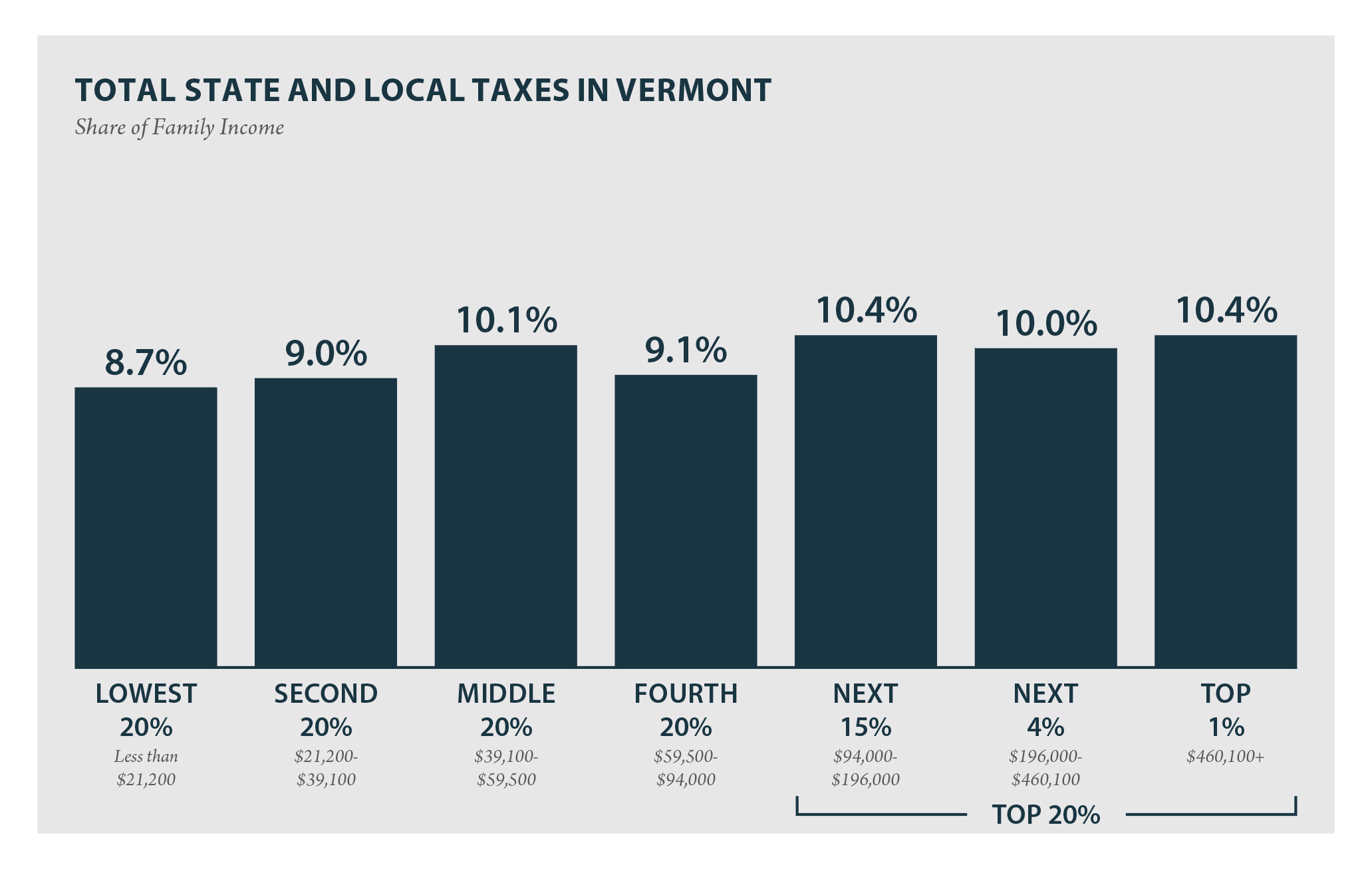

Vermont Who Pays 6th Edition Itep

File Top Marginal State Income Tax Rate Svg Wikipedia

Effective State Income Tax Map Public Assets Institute

The Most And Least Tax Friendly Us States

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

How The House Tax Proposal Would Affect Vermont Residents Federal Taxes Itep

Historical Vermont Tax Policy Information Ballotpedia

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

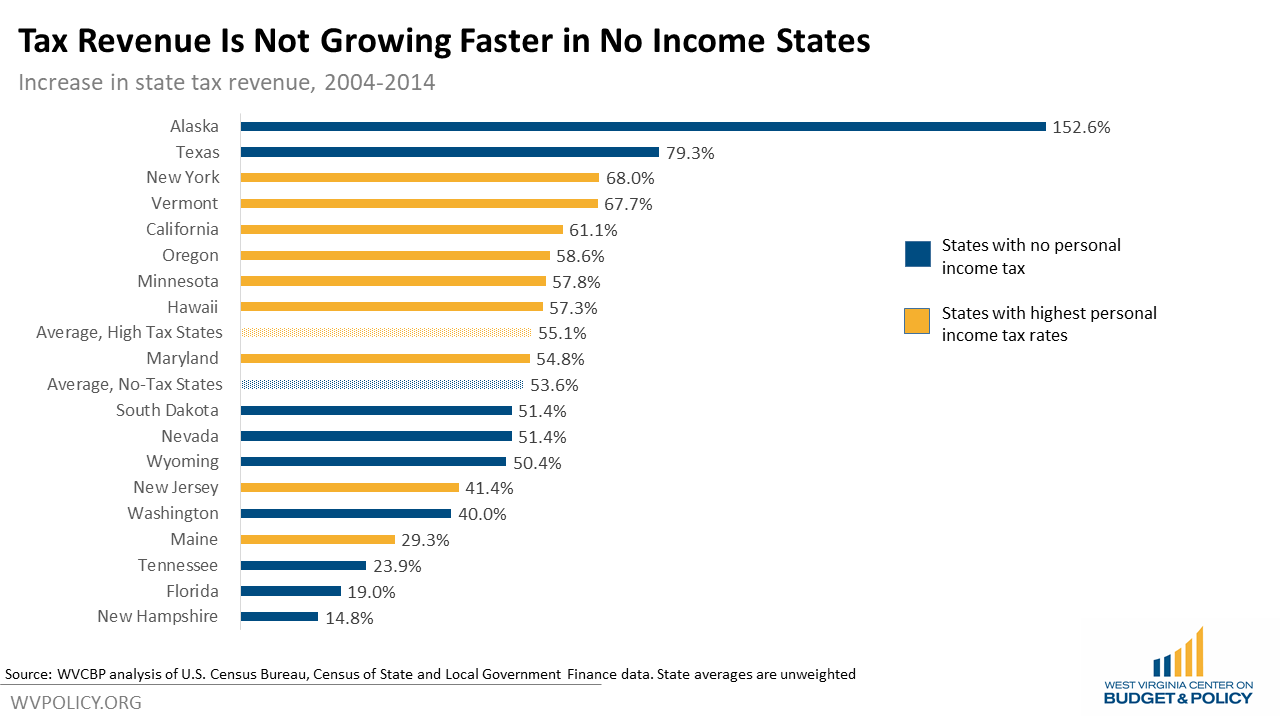

House Personal Income Tax Cut Plan Largely Benefits Wealthy Not Fiscally Sustainable West Virginia Center On Budget Policy